VMA for Insurance Providers

Optimize Mental Health Claims with Accurate, Data-Driven Insights

Optimize Mental Health Claims with Accurate, Data-Driven Insights

Reduce claim costs, track patient outcomes, and enhance decision-making with our proprietary algorithm-based mental health assessments designed for insurance providers.

The Challenges Facing Insurance Providers Today

With the rise in mental health service demand, insurance providers face significant challenges in managing claims efficiently. From rising claim costs to difficulties ensuring standardized assessments, the burden on insurance teams is heavier than ever. Fragmented patient data compound this, making it difficult to track patient outcomes, measure intervention effectiveness, and comply with regulatory requirements.

- High administrative costs associated with processing mental health claims.

- Difficulty in standardizing assessments across multiple healthcare providers.

- Fragmented patient data complicates outcome tracking and effectiveness measurement.

- Regulatory pressure to comply with mental health parity laws.

How VMA’s Platform Solves These Challenges

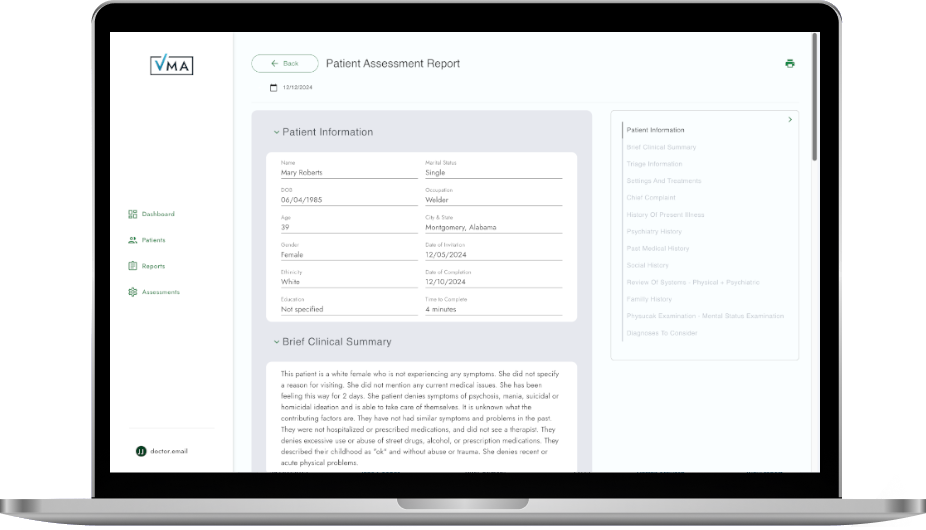

VMA offers insurance providers a powerful, streamlined solution for managing mental health claims. Our platform provides standardized, evidence-based assessments that can be used across multiple healthcare providers, ensuring consistency in diagnoses and treatment recommendations. Proprietary algorithms deliver accurate insights into patient outcomes, reducing administrative overhead and optimizing the claims process.

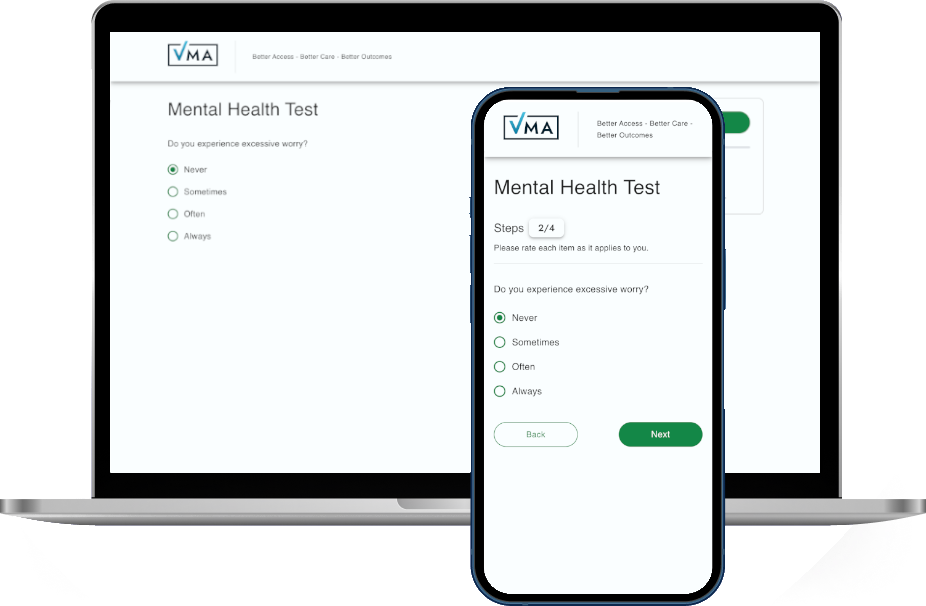

- Standardized Mental Health Assessments:

Our platform provides evidence-based assessments that can be universally applied, ensuring consistent, accurate diagnoses and treatment recommendations for all mental health claims. - Data-Driven Insights for Claims: VMA’s platform uses proprietary algorithms to provide real-time insights into patient outcomes. This allows insurance companies to better manage claims, optimize coverage decisions and control costs.

- Outcome Tracking & Reporting: Our platform tracks patient outcomes and generates comprehensive reports, helping insurers evaluate the effectiveness of mental health interventions and improve reimbursement strategies.

- Regulatory Compliance: VMA ensures insurance providers stay compliant with mental health parity laws, helping you meet legal requirements while managing claims more effectively.

Optimize Your Mental Health Coverage with Data-Driven Insights

Why Leading Insurance Providers Trust VMA

Insurance providers across the nation trust VMA to offer reliable, scalable solutions that help optimize mental health claim management, improve patient outcomes, and reduce administrative costs. Here’s why:

- Cost-Effective Claims Management: Our precise assessments and data-driven insights reduce the cost of processing mental health claims.

- Accurate Outcome Tracking: Track patient outcomes over time to measure the effectiveness of treatments and optimize reimbursement strategies.

- Standardized Assessments: Ensure diagnostic accuracy and consistency across healthcare providers using evidence-based, standardized assessments.

- Regulatory Compliance: Stay within legal guidelines for mental health parity, ensuring that insurance plans fairly cover mental health conditions.

How VMA’s Platform Works for Insurance Providers

- Step 1: Provider-Assisted Assessments: Healthcare providers utilize VMA’s standardized assessments to ensure accurate, consistent mental health diagnoses and treatment recommendations.

- Step 2: Proprietary Data Analysis: The platform analyzes patient data using our proprietary algorithms, helping insurance providers track patient outcomes and optimize coverage decisions.

- Step 3: Outcome Reports & Claims Optimization: Comprehensive reports are generated, allowing insurance companies to measure treatment effectiveness, track patient progress, and streamline claims.

- Step 4: Integration with Existing Systems: VMA integrates with existing claims processing and data management systems, providing seamless access to mental health data and supporting more informed decision-making.

The Key Benefits of VMA’s Platform for Insurance Providers

Cost Savings

Improved Patient Outcomes

Standardization

Compliance

Data Security

Optimize Your Mental Health Coverage with Data-Driven Insights

Our Qualified Doctors

Dr. Mark S Jhonson

Dr. Merry Armstrong

Dr. David Warner

Dr. Josephine Langford

Testimonials

Whether you're new to the review platform market, well-seasoned yet searching, or if you just want to make sure you're getting the most out of your deal, this guide will go through a handy review demo checklist to guarantee you get the best.

Mark S Jhonson

Whether you're new to the review platform market, well-seasoned yet searching, or if you just want to make sure you're getting the most out of your deal, this guide will go through a handy review demo checklist to guarantee you get the best.

Mitchell Marsh

Whether you're new to the review platform market, well-seasoned yet searching, or if you just want to make sure you're getting the most out of your deal, this guide will go through a handy review demo checklist to guarantee you get the best.

Mark S Jhonson

Whether you're new to the review platform market, well-seasoned yet searching, or if you just want to make sure you're getting the most out of your deal, this guide will go through a handy review demo checklist to guarantee you get the best.

Mitchell Marsh

Why Choose Us

Qualified Doctors

Emergency Services

Online Payment

Affordable Billing

Emergency Services Available

Frequently Asked Questions